Pro Business Tax

Corporate Tax Planning & Strategies

Corporate Tax Planning in Canada (Excluding Quebec)

Video Introduction

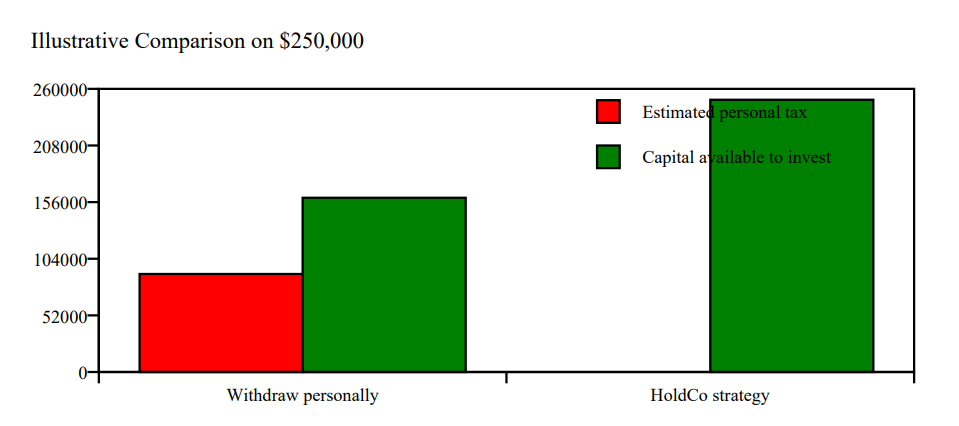

Case Study – Investing $250,000 Without a $90,000 Personal Tax Hit (Illustrative)

A client wanted to buy an investment property using $250,000 inside the corporation. Before

proceeding, they asked for advice. We implemented a holding company strategy so funds could be

deployed more tax-efficiently, instead of withdrawing personally first.

Illustrative outcome: A personal withdrawal could have created an estimated $90,000 tax bill (varies

by income and withdrawal method). With proper structuring and documentation, that immediate

personal tax cost was avoided and more capital remained available to invest.

Why Structure Matters

What We Help With (GMB)

- Holding companies and retained earnings planning

- Asset protection considerations

- Share freeze and succession planning

- Selling business to children (where applicable)

- Tax-efficient structures and documentation

Get a Free Consult

FAQ – Corporate Tax Planning

Yes. We focus on CRA-compliant planning with proper documentation

Not always. We recommend the simplest strategy that achieves your goals.

Yes. We design and document strategies based on your facts and plans.

Yes, excluding Quebec filing/reporting