Pro Business Tax

Bookkeeping Cleanup & Catch-Up Services

Bookkeeping Cleanup & Catch Up Services in

Canada (Excluding Quebec)

Bookkeeping Cleanup & Catch Up Services in Canada (Excluding Quebec)

Video Introduction

Case Study – 4 Years Behind, Fixed in 4 Weeks

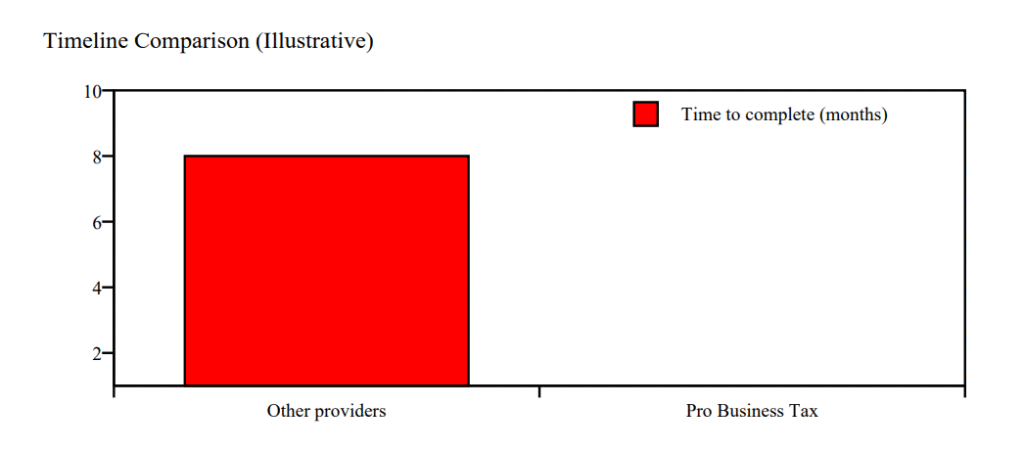

A clinic was nearly 4 years behind with bookkeeping and filings. Prior providers struggled for ~8

months with delays and friction. Our in-house bookkeepers organized the data and reconciled

accounts; our CPAs reviewed for tax readiness. Result: everything was cleaned up and ready for

filing in 4 weeks — fast, accurate, low-stress.

8 months vs 4 weeks

What You Get

- Clean, reconciled books (bank/credit cards matched)

- Proper categorization (deductions captured correctly)

- Clear financial statements you can trust

- Tax-ready handoff to our CPA team (no rework)

- A simple pending-items checklist (you always know what’s next)

Pricing

Monthly bookkeeping plans start at $149/month. Cleanup projects are quoted after a quick

assessment based on complexity and how far behind the books are.

Get a Free Consult

Frequently Asked Questions

We can clean up months or multiple years depending on records and complexity.

It depends on volume and access to records. Many projects move quickly due to a coordinated,

CPA-led workflow.

Typically bank/credit card access, payroll reports (if any), and any missing invoices/receipts. We

provide a clear checklist.

Yes. We work in QuickBooks Online and Xero

No. We do not serve Quebec filing/reporting requirements.